Retirement is an inevitable stage of life, and it requires careful planning to ensure financial security and stability during this phase. Nepal, a beautiful Himalayan country, has a unique culture and lifestyle that is affordable for retirees. In this blog, we will discuss the cost of retirement in Nepal and provide some insights into planning for retirement in this country.

Basic Expense

Firstly, let’s talk about the basic expenses that retirees have to bear in Nepal. The cost of living in Nepal is relatively low, making it an affordable destination for retirees. According to Numbeo, the average monthly living cost for a single person in Nepal is around NPR 46,691 ($390), which includes rent, utilities, and groceries. For a couple, the cost is slightly higher, around NPR 77,817 ($650) per month. As per our best estimation based on experience and information from locals, the average monthly living cost for a single person in Nepal should be around NPR 20,000 ($153).

Housing

Housing is one of the major expenses for retirees, and Nepal offers various options for affordable housing. The average cost of renting a one-bedroom apartment in Kathmandu, the capital city of Nepal, is around NPR 20,000-30,000 ($167-$250) per month, while a two-bedroom apartment costs around NPR 30,000-50,000 ($250-$417) per month. You can consider living in hostels where the average monthly cost for accommodation and food will be around 12,000 NPR ($92). If you are looking for more budget-friendly options, you can consider living in smaller towns and villages in the outskirts of cities, where the cost of living is even lower.

Healthcare

Another significant expense for retirees is healthcare. In Nepal, the cost of healthcare is relatively low compared to other countries, making it an affordable option for retirees. However, it is essential to ensure that you have health insurance that covers medical emergencies and hospitalization. The cost of health insurance in Nepal is relatively low, and you can get coverage for as low as NPR 7,000 ($58) per year.

Transportation

Transportation in Nepal is also affordable, with various options available, including taxis, buses, scooters and motorcycles. The cost of public transportation in Nepal is relatively low, with a bus ride costing around NPR 20 ($0.17) per person and a ride-sharing app like Pathao and InDrive costing from around NPR 60. If you prefer to travel by motorcycle, you can buy one for as low as NPR 80,000 ($667) in second-hand markets.

Food

Food is another major expense for retirees, but Nepal offers affordable options for both local and international cuisine. The cost of food in Nepal varies depending on your location and preferences, but a basic meal in a local restaurant costs around NPR 250-300 ($2-$2.50), while a more upscale restaurant can cost around NPR 1,000-1,500 ($8-$12.50) per person.

While retirement may seem like a distant and abstract concept for people in their 20s, it is essential to start thinking about and planning for retirement as early as possible. Here are some reasons why:

Compound Interest: One of the significant benefits of starting early retirement planning is the power of compound interest. By investing in retirement funds or other financial instruments early, your money has more time to grow and generate returns, allowing you to accumulate more significant wealth over time.

Longer Time Horizon: Starting early also means that you have a longer time horizon to save and invest for retirement. This can help you achieve your retirement goals without having to save as much each year. Waiting until later in life to start saving for retirement can make it much more challenging to achieve your goals.

Uncertainty of Social Security: The future of social security is uncertain, and it is not clear if it will be available or sufficient to meet everyone’s retirement needs in the future. By starting early and building your retirement savings, you can ensure that you have enough resources to support yourself during retirement.

Unexpected Life Events: Life can be unpredictable, and unexpected events such as illness, job loss, or other financial emergencies can significantly impact your ability to save for retirement. Starting early and building a solid retirement plan can provide a safety net and help protect your future financial security.

Starting early retirement planning is crucial for people in their 20s as it can provide significant long-term benefits such as compound interest, a longer time horizon, and protection against unexpected life events. By planning and taking action early, you can help secure a comfortable and financially stable retirement.

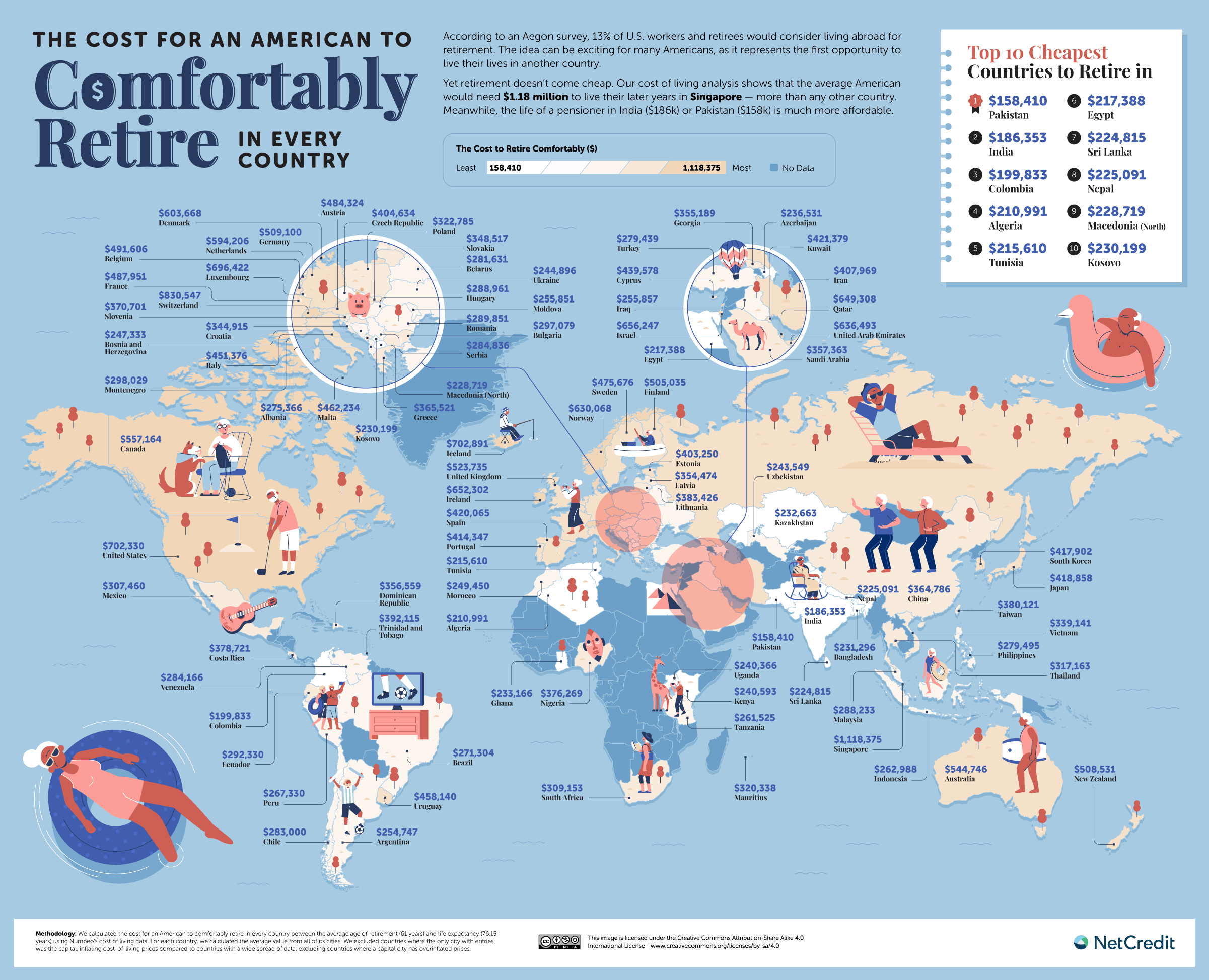

According to a recent survey by Aegon, it was found that 13% of US workers and retirees would consider living abroad for retirement. While the idea of living in another country can be exciting, it’s important to remember that retirement can be expensive.

A cost of living analysis by Numbeo shows that the average American would need $1.18 million to retire comfortably in Singapore, making it the most expensive country for retirement. However, for those looking for a more affordable retirement, countries such as India and Pakistan are much more reasonable options, with retirement costs estimated at $186k and $158k, respectively.

Top 10 Cheapest Countries to Retire in: (Source: Aegon Survey)

- Pakistan: $158,410

- India: $186,353

- Colombia: $199,833

- Algeria: $210,991

- Tunisia: $215,610

- Egypt: $217,388

- Sri Lanka: $224,815

- Nepal: $225,091

- Macedonia (North): $228,719

- Kosovo: $230,199

It’s essential for those planning their retirement to consider not only their desired location but also the cost of living in that country. This can have a significant impact on the amount of money needed to support oneself during retirement. By taking into account the cost of living in different countries and planning accordingly, retirees can ensure they have the financial resources to support their desired lifestyle during their golden years.

Retirement is an important topic that requires careful consideration and planning. Starting early with retirement planning can help individuals maximize the power of compound interest and achieve their financial goals. Additionally, the future of social security is uncertain, making it essential to build a solid retirement plan that can provide a safety net against unexpected life events.

Pingback: Digital Nomad’s Cost for Living in Kathmandu – FromEverest